[White Paper] Turning Down Turnover: Key Insights and Recommendations to Improve Business Operations

by Actabl and AHLA’s Management Company Committee

Turning Down Turnover

In the ever-evolving world of hotels, one persistent challenge continues to reverberate – employee turnover. This white paper highlights the far-reaching effects of turnover on hoteliers’ financial health and shares some industry-specific benchmarks so hoteliers can get a sense of their performance relative to their peer set. Furthermore, it explores innovative strategies to enhance employee retention and streamline operational costs. The data shared in this paper comes from the Actabl labor index including over 4,000 U.S. hotels represented by 22,000+ team members.

The opinions shared in this paper are those of Adam Glickman, Actabl’s VP of Brand Strategy, and include insights and creative solutions offered by AHLA’s Management Company Committee.

Unraveling the Financial Implications of Turnover

Turnover isn’t merely a staff replacement process; it’s a financial P&L consideration. Common knowledge tells us that the expenses of replacing an employee can be costly, potentially reaching up to 30% of an individual’s annual compensation. Consider recruitment costs, training time, and productivity.

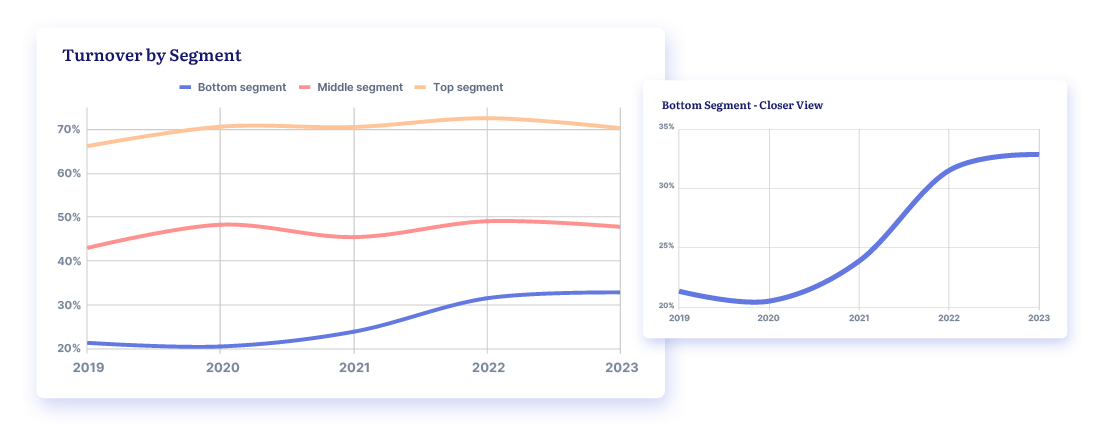

Actabl reviewed its proprietary turnover data for hotel employee positions over the last several years and broke turnover data for all U.S. hotels into segments, with the top segment being the one with the lowest turnover overall, and so forth. The most insight comes from evaluating the top segment, which has seen turnover rise 50% since 2019.

The potential business operations and financial impact of turnover for the top segment (high turnover hotels) are the most severe. Consequently, hotels in this category have the most to gain from reducing their turnover. For example, if a 40-position hotel (e.g. large select-service property) can move from the top segment to the middle, it would reduce turnover by approximately 8 people every year. At a 20% turnover expense against an annual pay amount for a part-time employee that totals $30,000 per year, that would equate to $6,000 X 8 = $48,000 turnover cost savings.

By position, the biggest trend change to observe is an increase in leadership turnover. Managers departed our industry during the pandemic, and although some returned, many newly hired managers are new to our industry. We are seeing 25%-35% greater turnover from managers than we did in 2019, as you can see below.

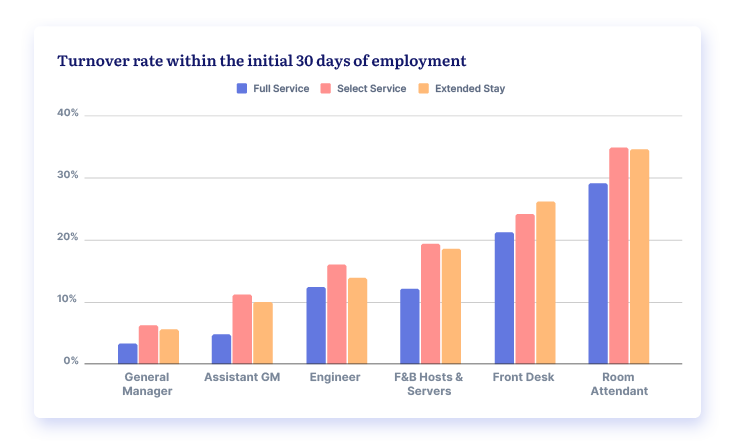

Delving deeper into the realm of turnover trends, a distinct transformation has emerged. The pandemic triggered a shift, altering the approach of retaining experienced staff and intensifying the challenges of cultivating and retaining fresh talent. The turnover rate within the first 30 days of employment, or “quick-turn” rate, has increased significantly from where it was pre-pandemic, and rates as of August 2023 are highlighted in the chart to the right. This quick-turn turnover should be monitored separately from regular turnover, and specific action plans should be developed to reduce it.

Taking Action: Recommendations to Move Your Business Ahead

Flexibility: A Reinvented Retention Approach

With alternative industry choices, such as gig work increasing in popularity, a new approach to retention is something hotels should consider. There is a surge in requests for flexible scheduling, and one option is embracing them in your business. To date, data isn’t showing a rapid growth in shorter, 4-hour shifts, and our industry still maintains a typical shift length of 7-8 hours. As an industry, remote work is not possible for most operational hourly positions - but flexible work is. Consider the direct correlation among job satisfaction, loyalty, and adaptive scheduling practices. As a flexible scheduling option, consider offering full-time schedules that include four weekly 10-hour shifts in parallel with shorter shift windows for part-time associates.

Embracing Adaptability Through Contract Labor

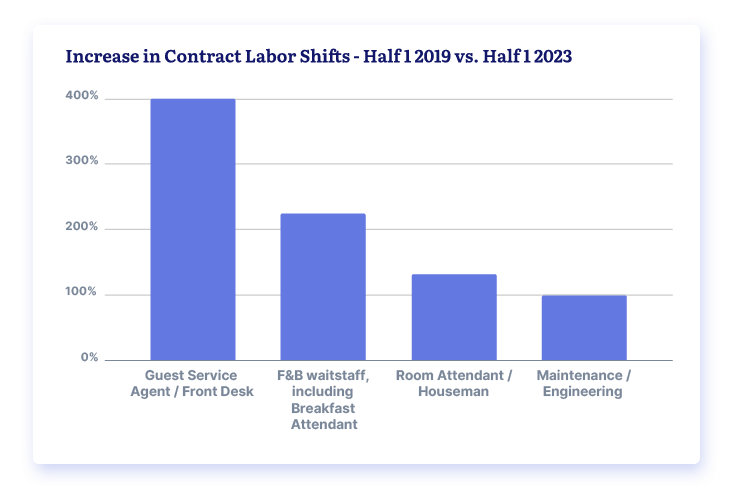

The use of contract labor isn’t new, but the volume at which it is utilized in our industry has risen dramatically in the past several years. From a business standpoint, contract labor presents a paradox. On one hand, it offers a flexible solution, empowering hotels to respond to shifting demands efficiently. The transient nature of contract labor facilitates quick onboarding and offboarding, often avoiding the fixed costs associated with traditional employment. On the other hand, this operational dynamism comes with its set of challenges. Some contract workers, being transient contributors, might not be able to deliver on brand culture, values, or custom service delivery in the same fashion as company employees.

While it may lead to quicker service during peak periods, the variance in experience could potentially compromise consistency. In some cases, contract team members perform at different productivity levels or require extra time in advance of shifts for training, which adds to the base cost of contract labor. Working with a reputable contract labor provider or agency that has their own defined standards and processes, can often alleviate these challenges.

To the right is an analysis of contract labor usage growth from January through June 2019 (Half 1) versus the same time period in 2023. Recognizing contract labor’s growth, strategies to ensure the quality consistency of contract team members, and managing the balancing act of contract labor

versus overtime is a focus area for 2024.

Navigating Turnover Challenges

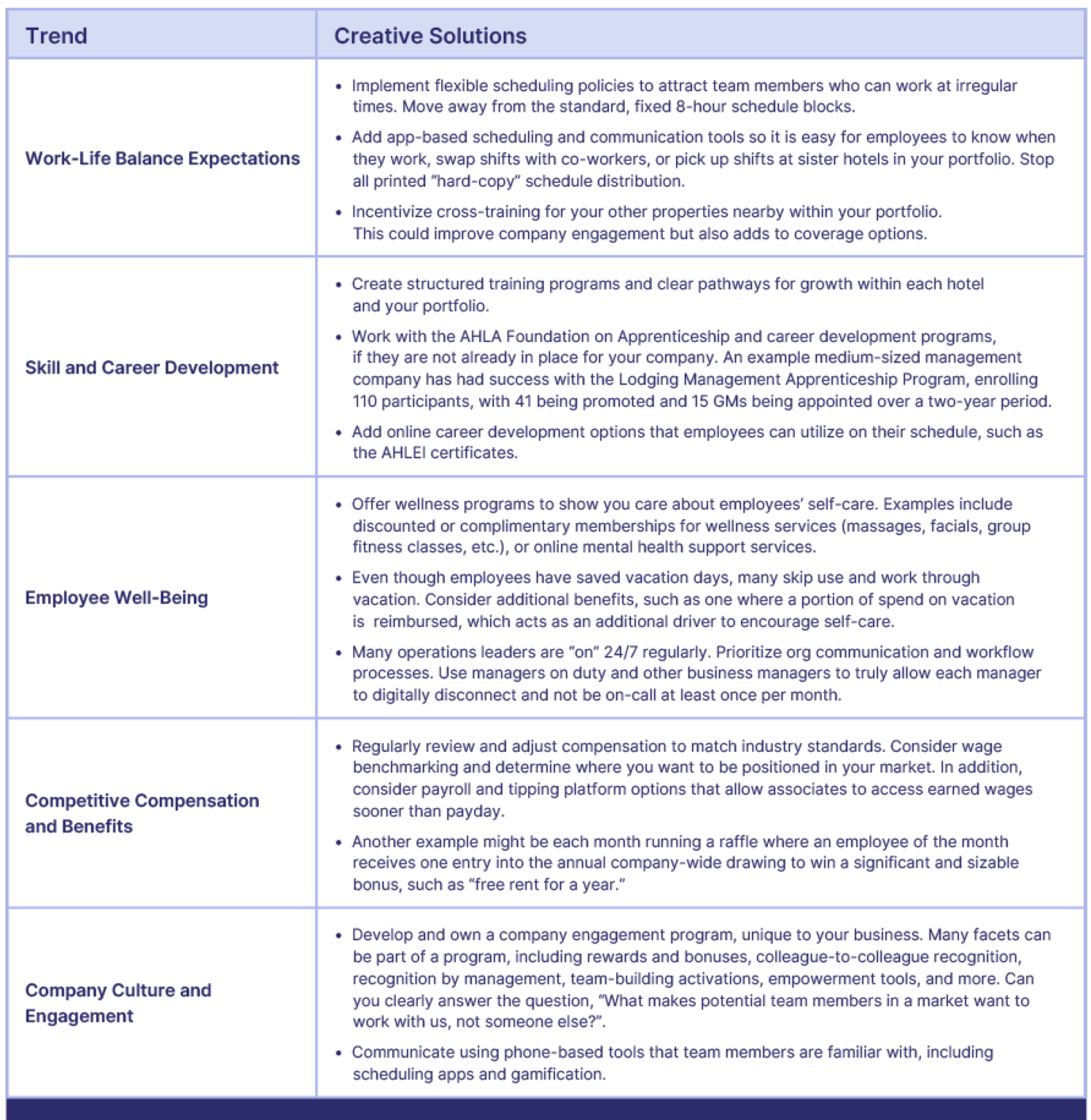

Understanding key trends and implementing strategic countermeasures is paramount to mitigate turnover impacts. Here are the top five trends that are shaping turnover dynamics, along with creative solutions.

About Actabl

Actabl is the leader in hospitality business intelligence, labor management, and hotel operations management software that provides actionable insights to above-property leaders and on-property leaders. Actabl brings together four powerful hospitality tech solutions to maximize profits for hotel operators. Actabl’s integrated solutions include ProfitSword’s business intelligence technology, Hotel Effectiveness’ complete labor optimization, ALICE’s hotel operations management platform, and Transcendent’s advanced asset management and CapEx. With a global team of 300+ employees boasting over 1,000 years of combined hospitality experience, Actabl serves the technology needs of more than 12,000 properties in hospitality markets around the world.

About AHLA

The American Hotel & Lodging Association (AHLA) is the largest hotel association in America, representing more than 30,000 members from all segments of the industry nationwide – including iconic global brands, 80% of all franchised hotels, and the 16 largest hotel companies in the U.S. Headquartered in Washington, D.C., AHLA focuses on strategic advocacy, communications support, and workforce development programs to move the industry forward. Click to learn more about AHLA, AHLA Foundation, AHLA Foundation Apprenticeship or AHLEI.

AHLA’s Management Company Committee

AHLA’s Management Company Committee is a member-exclusive group of top Management Company executives who manage hotel operations to grow the association’s grassroots engagement, discuss top issues affecting hotel operators, and strengthen the voice of the industry.